In today’s digital age, the need for secure and reliable identification of financial documents has become more important than ever. This is where the Unique Document Identification Number (UDIN) comes in. The Institute of Chartered Accountants of India (ICAI) has introduced a new portal for UDIN issuance, making it easier for chartered accountants to authenticate their clients’ documents.

The UDIN ICAI Portal is an essential tool that helps professionals streamline their work while ensuring that all financial documents are authentic and verified. With the help of this portal, CAs can create unique IDs for each document they verify or attest to, which helps prevent fraud and ensures accuracy in financial reporting.

UDIN ICAI Login Details

The Unique Document Identification Number (udin verification) is an essential tool for maintaining transparency and authenticity of documents. The Institute of Chartered Accountants of India (ICAI) has introduced the UDIN system to ensure that every certificate, report or other document issued by a chartered accountant is verified as authentic and genuine. This system aims to prevent frauds and manipulation in financial documentation.

The UDIN ICAI Portal is an online platform that allows registered chartered accountants to create and register their unique UDINs on the portal. The portal offers various features such as generating, verifying, searching, and revoking of the UDINs. Once generated, a UDIN can be used only once for a specific document created by the concerned chartered accountant. By using this portal, clients can verify whether the document they have received from their CA is authentic or not.

Function of UDIN ICAI Portal

The Institute of Chartered Accountants of India (ICAI) has introduced the Unique Document Identification Number (UDIN) portal to enhance the authenticity and credibility of various certificates issued by Chartered Accountants. The UDIN comprises a unique 18-digit number assigned to each document, providing an additional layer of security against fraud and counterfeiting.

- The primary function of the UDIN ICAI portal is to generate a unique identification number for each certificate issued by Chartered Accountants registered with the ICAI.

- This identification number helps in tracking the authenticity and validity of documents, making it easier for employers, lenders, investors, and other stakeholders to verify their legitimacy.

- Additionally, this initiative aims at bringing transparency in financial reporting and compliance systems across different sectors.

- Another critical feature of the UDIN ICAI portal is that it guarantees data confidentiality while ensuring ease-of-access.

Services provided by UDIN ICAI Portal

- One of the key services provided by the UDIN ICAI portal is the issuance of UDINs for various financial documents such as audit reports, certificates, and other attestations.

- This service ensures that these documents can be easily verified for their authenticity, reducing instances of fraud or misrepresentation.

- Additionally, this process also helps to maintain transparency in all financial transactions.

- The UDIN ICAI portal also provides a verification facility that allows stakeholders to verify the authenticity of any document bearing a UDIN number.

How to apply UDIN Registration?

As part of the initiative to increase transparency and accountability in the accounting profession, the Institute of Chartered Accountants of India (ICAI) has introduced a Unique Document Identification Number (UDIN). The UDIN is a 15-digit alphanumeric number that identifies documents signed by a chartered accountant. This number is unique and can only be generated once per document.

- To apply for UDIN registration, chartered accountants must first register themselves on the ICAI portal.

- They will then be required to provide their personal details and upload scanned copies of their photo ID, signature, and qualification certificate.

- Once registered, they can generate UDINs for all documents they sign, including certificates, reports, financial statements, tax returns, and other attestations.

- It is important to note that UDIN registration is mandatory for all practicing chartered accountants in India.

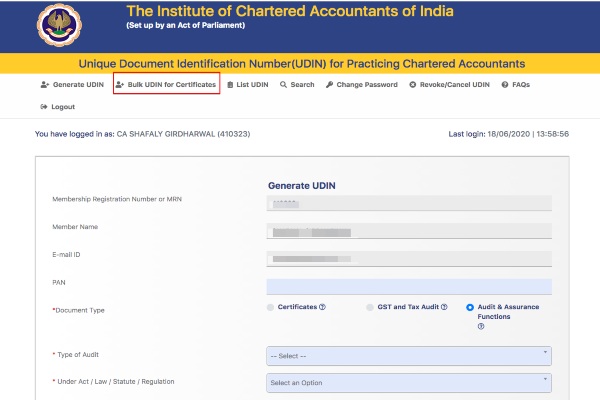

How to login UDIN ICAI?

If you are a member of the Institute of Chartered Accountants of India (ICAI), you might have heard about the Unique Document Identification Number (UDIN) system. This system aims to enhance the authenticity and credibility of documents certified by practicing chartered accountants. To generate UDIN, ICAI has introduced an online portal that members can use after successful login.

- To access the UDIN portal, you need to follow specific steps for ICAI login.

- First, visit the official website of ICAI and click on ‘UDIN’ under the ‘Members’ tab.

- Next, select ‘Login/Register’ to access the login page. You can either use your membership number or registered email ID as a username and enter your password to proceed.

How to Generate UDIN ICAI for your Documents or Certificate?

If you are a chartered accountant, then UDIN or Unique Document Identification Number is something that you must be familiar with. Introduced by the Institute of Chartered Accountants of India (udin generation), UDIN is an 18-digit unique number that helps in identifying a particular document or certificate issued by a CA. This identification number aims to prevent fraudulent activities and promote transparency.

- To generate a UDIN for your documents or certificates, you need to visit the ICAI’s official website and log in using your credentials.

- Once logged in, go to the ‘UDIN’ tab and select ‘Generate UDIN’.

- Enter the necessary details such as your membership number, date of issuance of certificate/document, document type, etc., and click on ‘Generate’.

- The system will generate an 18-digit unique ID that can be used to identify your document/certificate.