ongc bandhan payslip

ONGC Bandhan payslip is a great way to manage your finances. It provides you with the ability to view and download your salary slips directly on the website. It also allows you to track deductions, contributions and any other tax related information associated with your salary slip in real time.

Whether you are an employee of ONGC or currently employed by any organization, the Bandhan payslip can help streamline all your financial needs. This not only ensures that you have access to detailed information about your payments but also allows for ease of tracking as well. You can use this platform for checking deductions, contributions, advances and other payroll related activities in one place for quick reference. The payslip is available in both digital and physical formats giving users the flexibility to choose their preferred mode of viewing their payment details.

importance of ongc bandhan payslip

- The OGNC Bandhan Payslip is an important document for employees of the Oil and Natural Gas Corporation (ONGC).

- It serves as a proof of employment, salary details and other useful information about an employee’s earning.

- The payslip provides a detailed insight into the employee’s total earnings, deductions, allowances and leaves that have been credited.

- This information is essential for filing income tax returns as well as managing one’s budget efficiently.

- Having access to the ONGC Bandhan payslip also helps employees keep track of their salary increments and deductions over time.

- This allows them to plan their finances better and make informed decisions on their investments.

- Furthermore, it is important to keep records of the payslips in case there are any discrepancies between the actual data provided by ONGC and what is shown on your bank statement.

Services provided by ongc bandhan payslip

- Oil and Natural Gas Corporation (ONGC) Bandhan Payslip is an online platform that provides a gateway to pay slips for employees of the ONGC.

- This web-based service enables users to access payslips from their desktop or mobile device without having to manually collect physical copies of the documents.

- It also provides useful details such as deductions, bonuses, and other benefits associated with salary payments for employees.

- The ONGC Bandhan Payslip was created to streamline payroll processing by providing an automated system for viewing salaries and other related information.

- The platform also offers a secure login system where users can securely access their salary slips without fear of data leakage or interference from malicious actors.

- Additionally, it allows users to view payslips within minutes after they are submitted, thus making the process more efficient and convenient.

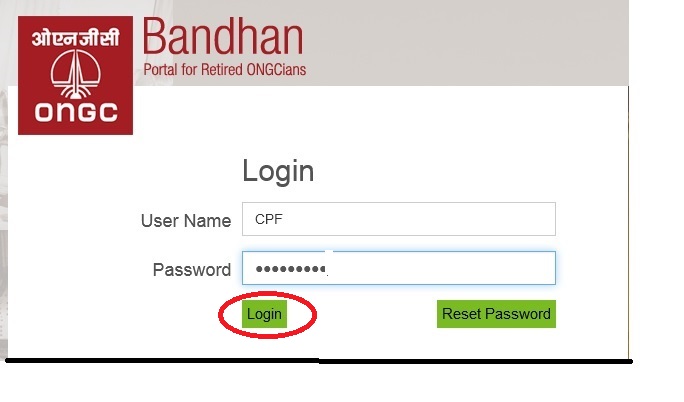

ONGC Bandhan Payslip Login

Logging into ONGC Bandhan Payslip is incredibly easy and fast. Here, we’ll discuss the steps to log in and access your payslip quickly.

- The first step is to visit the official website of ONGC Bandhan portal which is https://www.ongcindia.com/wps/portal/.

- Once you are on the homepage, you will have to look for “Payslip Login” option near the bottom right corner of the page.

- After clicking it, you will be redirected to a new login page where you need to enter your User ID (Employee Code) and password in order to access your payslip information such as payheads, deductions, allowances etc.

How to download ongc bandhan payslip

Downloading ONGC Bandhan payslip is a simple and uncomplicated process. This article will guide you through the steps to successfully download your payslip.

- To start, log into your ONGC Bandhan Account by entering your user ID and password.

- Once you have logged in, click on ‘Pay Slips’ tab located on the left side of the home page.

- Here, you will be able to view all of your payslips from past months or years.

- Select the month for which you would like to download a payslip and click ‘View’ next to it.

- A new window will appear with the details of your selected month’s payslip along with a button that says ‘Download PDF’ at the bottom right corner of the page.