Chhattisgarh Employee Salary Slip

Chhattisgarh Employee Salary Slip is a document that contains detailed information about the salary of an employee. It includes the basic pay, allowances, deductions and net pay of the employee for a particular month. This document is issued by the employer and is an essential proof of income for employees.

The Chhattisgarh government has made it mandatory for all employers to provide their employees with monthly salary slips. This initiative aims to create transparency in payroll management and ensure that employees receive their rightful dues. The salary slip also helps employees understand their salary structure better and plan their finances accordingly.

The Chhattisgarh Employee Salary Slip contains important information such as the name of the employee, designation, date of joining, bank account details, gross pay, deductions such as tax, PF contribution etc., and net pay.

Importance of Chhattisgarh Employee Salary Slip

- The employee salary slip is an integral part of any organization.

- It serves as a record of the employee’s earnings and deductions for a given period.

- In Chhattisgarh, the importance of the employee salary slip cannot be overstated.

- Not only does it serve as a proof of income for employees, but it also helps employers to keep track of their payroll expenses.

- Employee salary slips in Chhattisgarh are also important for tax purposes.

- The state government requires employers to deduct taxes from their employees’ salaries and deposit them with the tax authorities on time.

- The salary slip provides proof that these deductions have been made and help both employees and employers stay compliant with tax regulations.

- Furthermore, employee salary slips in Chhattisgarh play an important role in managing finances.

Epayroll Payslip CG Police

Epayroll Payslip CG Police: A Revolutionary Solution for Police Payroll Management

- Managing payroll has always been an arduous task, particularly in large organizations such as the police force.

- In traditional payroll management systems, it takes several days to process salaries of employees and sometimes even longer if there are any discrepancies.

- The introduction of Epayroll Payslip CG Police has revolutionized this process by providing a one-stop solution for all the challenges faced in payroll management.

- The software is designed specifically for police forces and provides numerous benefits to employers and employees alike.

- With Epayroll Payslip CG Police, payslips can be generated within minutes with complete accuracy, ensuring that employees are paid on time without any delays or errors.

- The system also eliminates the need for paper-based payslips, which not only saves time but also reduces environmental impact.

How to download Epayroll Payslip CG Police

If you are a CG Police employee, you may want to access your Epayroll Payslip for various reasons. The online platform offers a convenient way of viewing and downloading your salary details right from the comfort of your home or office. It also ensures that you always have a copy of your payslips whenever you need it.

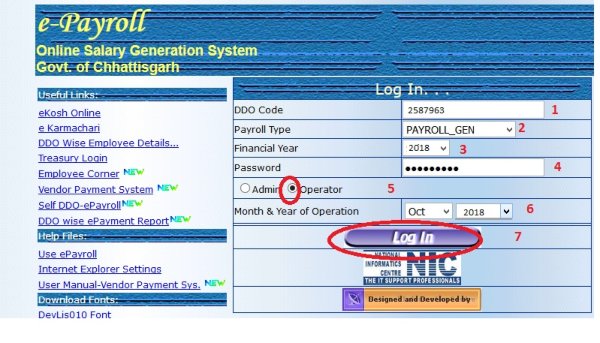

- To download your Epayroll Payslip CG Police, the first step is to visit the official website of the Chhattisgarh police department.

- Once there, navigate to the ‘Epayroll’ section and click on it.

- You will be redirected to another page where you will need to fill in some details such as your employee ID number, date of birth, and password.

- Once you have provided all required information and logged in successfully, locate the ‘Payslip’ option on your dashboard and select it.