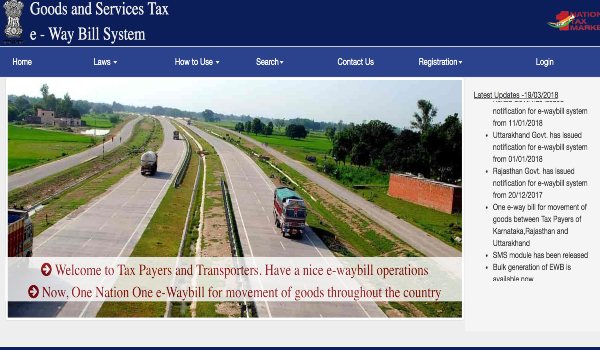

The e way bill login portal is an online platform that allows businesses to easily and securely submit the necessary documents for the transportation of goods. This online portal simplifies and streamlines the process of obtaining an e-way bill, which is a document required for the movement of any consignment valued above ₹50,000. It provides complete visibility over the movement of goods across India and helps ensure smooth transportation experiences for all parties involved.

e way bill generation

The e-way bill portal is an important tool for businesses and individuals who are engaged in the transportation of goods. It provides an efficient way to generate, track and manage invoices related to the movement of goods. The e-way bill portal was introduced by the government as part of its efforts to digitize India’s tax system. With this system, taxpayers can quickly submit their Goods and Services Tax (GST) returns with ease.

To access the e-way bill login portal, users must first register on it using their GSTIN (Goods and Service Tax Identification Number). Once registered, users will be able to submit invoices related to goods that have been transported for sale or for any other purpose within India. The login also allows users to check their balance sheet details such as pending payments, past payments and more.

Objectives of e way bill login portal

- The e way bill login portal facilitates the efficient execution of goods and services tax (GST) compliance in India.

- The objective of the e way bill login portal is to facilitate a seamless, secure, and uniform system for all GST related activities.

- It also helps to simplify and streamline the process of filing GST returns by providing an easy-to-use online platform.

- The main objectives of the e way bill login portal are to ensure smooth flow of interstate movement of goods without any interruption or disruption due to lack of documentation; reduce evasion and fraudulent activities on part of taxpayers; and provide a single point access for taxpayers, transporters, industry associations, freight forwarders etc., for obtaining information about their transactions seamlessly.

- Additionally, it provides real time tracking capabilities which enable users to view their transaction status with ease.

Features of e way bill login portal

- The e-way bill login portal is an important tool for businesses to manage their goods and services transport.

- It offers a range of features that make it easy for users to track the movement of goods and services across India.

- With the help of this portal, businesses can save time, money and resources by streamlining their processes.

- One major feature of the e-way bill login portal is its sophisticated dashboard which allows users to monitor all transactions in one place.

- The dashboard helps businesses to quickly access information on their shipments such as origin, destination, tax applicable, value added tax (VAT), weight, etc., which helps them keep track of their goods movements effectively.

- In addition, businesses can also generate reports from the dashboard which provides valuable insights into their operations.

How to login e way bill portal

Logging in to the e-way bill portal is an easy and straightforward process that requires only a few steps. It is important for individuals, businesses, transporters and intermediaries to be familiar with the login process as it is required for various activities related to the e-way bill system.

- The first step towards logging in to the e-way bill portal is registering on the government website of GST (Goods and Services Tax).

- After entering basic details such as name, contact number, email address etc., one has to select a desired e way bill login id password.

- Once registered, users can easily access their account using their given credentials.

- Moreover, if they have forgotten their password they can use ‘Forgot Password’ option available on the website.

How to Generate E-Way Bill

Generating an e-way bill is the latest requirement for businesses in India, and it’s important to understand the process. An e-way bill is an official document required by the government for all goods transfers with a value above 50,000 rupees. To generate one, you’ll need to have certain information about yourself, your suppliers and customers available on hand.

- The first step to generating an e-way bill is registering on the Government’s Goods and Services Tax (GST) Network website.

- Next you’ll need to provide GSTIN numbers of both supplier and customer along with other relevant details such as date of supply, value of goods etc., which can be found in invoices or bills generated at each stage of transport.

- Once this information has been entered into the system accurately, you will be able to generate an e-way bill automatically within minutes.